PartnerOptimizer introduces the Partner Ecosystem Intelligence Platform (PEIP), revolutionizing data intelligence for global B2B technology channel growth. Powered by its AI-engine, NeuralPartner, the new platform provides B2B tech companies with instant, unparalleled insight into their Ideal Partner Profile (IPP) using thousands of business attributes to truly uncover the DNA of their best performers and find lookalikes to force multiply revenues. The platform resolves the long-standing challenge of 20% of partners contributing 80% of revenue due to partner data blindness and achieves up to 600% faster IPP identification, and conversion rates 1,400% better, while reducing acquisition costs 539 percent * – critical metrics given a single good partner can drive 5 to 7 figures of ARR to a technology vendor/supplier.

Beyond recruiting, the PartnerOptimizer platform offers comprehensive insights to optimize a company’s partner ecosystem program. Analyzing the total addressable market, launching targeted initiatives, and understanding competitor partnerships are now seamlessly achievable.

Separate an IPP from an IP-VIP

“In 2023, 75% of revenue or more flows through the channel, and yet, the growth of most channel programs has remained capped by the 20/80 paradigm,” said PartnerOptimizer CEO and Partner Data Futurist Dina Moskowitz. “Until today, there was no platform, built from the ground up by channel partner pros, for partnership leaders to identify partners at a deep genetic level that makes it easy to separate out who at a ‘headline’ level looks like an IPP, but is not actually an IP-VIP worth investing in.”

Partner Data Blindness is Costly

The cost of this partner data blindness is stunning, stresses Moskowitz. “Companies spend millions in human capital and resources in the search for and in the onboarding and incentivizing of partners who ultimately don’t have the alignment to drive revenue,” says Moskowitz, noting for perspective that a partner manager making $120K a year spending just 10 hours a week (which is actually 60 days per year) researching prospects costs a company more than $30K.

Currently, according to Moskowitz, some of the most common tools and tactics (and their challenges) to build out partner data include the following:

- List purchases and info from data purveyors designed for direct sales. Both provide only a handful of firmographic information that doesn’t include an analysis on IPP match. The data will still require manual work to validate fit, which cannot match the depth of information provided by PO’s platform. Non-validated lists result in expensive “spray and pray” efforts, which risk attracting and onboarding non-IPP partners and will not deliver revenue.

- Account mapping tools. These solutions help companies see which partners and which vendors are engaged in a sale to facilitate accelerate co-selling, but do not provide access to robust IPP information on partners most likely to deliver revenue.

- Partner Relationship Management Platforms. These solutions help companies manage partners at nearly every step of the partner journey. However, they do not provide access to a partner discovery engine or provide IPP information beyond surface level performance metrics. IPP identification is critical as a first step – or these tools will never be as effective as they can be.

Understanding and finding the right partners is job No. 1

“Having the right partners comes first, everything thing else takes a back seat,” says Janet Schijns, renowned channel industry veteran and CEO of the JS Group, a leading go-to-market channel consultancy, noting that Partner Optimizer’s new platform is technology that turns partner pros into data scientists. “This platform allows you to be able to identify the partners that you are truly going to be successful with instead of guessing and inefficiently bogging down your organization with huge lists which may or may not be relevant. Guessing is costly – having the data is affordable.”

Optimize, use and refine every element of partner data

PartnerOptimizer’s NeuralPartner™ engine is uniquely fine-tuned to mine for business attributes that uniquely allow companies to understand a partner’s DNA and aggregate them into a data-driven IPP search. Those attributes include partner company types, solutions expertise, product expertise, target verticals, target customer types and sizes, tech stack insights, competencies, certifications, partner programs and compliances, and employee and revenue range, and more.

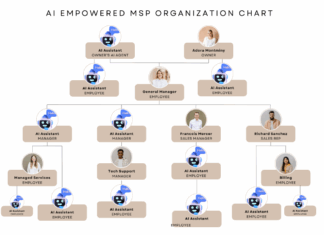

With the platform, partner leaders can turbocharge recruiting, and dig into the nuances and differentiation of different types of partners within their partner ecosystem. Examples of the partner types within the platform include MSPs, MSSPs, System Integrators, DevOps Consultants, SecDevOPS, MarTech Agencies, Ecommerce Companies, ERP Consultants, Telecom/Communications Agents, BI Consultants, and VARs. The platform also covers ISVs, SaaS companies and cloud infrastructure companies, which have emerged as powerhouse go-to-market co-sell partners for each other, and hundreds of thousands of partners who participate in one or more hyper-scaler ecosystems.

The platform brings 8 key powerful revenue features together into one offering:

1) Identifying IPP:

- Partner leaders must prioritize understanding their IPP. Previously, technology didn’t exist to truly profile identify why top partners perform well and replicate their success. PO’s new platform surprises customers with insights such as a view into each partner’s full technology stack, a crucial predictor of a successful sales motion and boosted sales due to bundled deals.

2) Discover and Qualify IPP Partner Matches:

- With a robust analysis of top partners, users can search the global partner ecosystem data base and/or analyze against their own partner prospect and existing lists using thousands of business attributes like solutions, product types, customer sizes, and certifications to build out their IPP ecosystem. The focus is on delivering quality partners to improve conversion rates and boost revenue.

3) Analyzing TAPEM (Total Addressable Partner Ecosystem Market):

- Every partner leader is on the line to understand market opportunity as part of business planning to map out investments, staff, budgets, technologies, etc. With the PO platform, for the first time it’s easy to analyze the entire B2B tech ecosystem to see how many partners are in a particular region, specialize in a particular vertical, represent a particular vendor, and more.

4) Zeroing in on Partners for Focused Initiatives:

- Throughout the year, marketing and sales teams are continually launching new initiatives against existing and new partners – seasonal promotions, regional events, etc. The PO platform simplifies targeting just the right partners with just the right data-driven attributes for marketing or sales campaigns.

5) Prepping for Recruiting and Performance Calls:

- A key role for every partner pro is prepping for recruiting and performance calls, which is generally manual and time consuming. PEIM automates that process, reducing prep times by 25 to 30 minutes per meeting, and making more time to place more calls per day.** And just as important, it ensures teams are not wasting time calling partners who are not a good IPP match, and frustrating both parties.

6) Keeping Partner Data Fresh:

- PartnerOptimizer facilitates ongoing health checks for vendors to ensure partners align with their IPP amid dynamic market changes. It helps monitor new partner emergence and churn, shifts in focus or personnel, trends like ZeroTrust adoption, political issues necessitating entry into new markets, and more. Additionally, the platform simplifies finding and adding new partners when introducing new solutions.

7) Auditing Brand Alignment:

- Millions are spent on Marketing Development Funds (MDF). PEIP makes it for easy vendors to analyze the digital presence of partners, ensure whether they are running promotions as agreed to and aligning with brand guidelines. With that knowledge, vendors can better understand which partners are actually co-selling with them effectively and reward them with additional investment

8) Understanding the Competitive Landscape:

- In the end, partner leaders need to understand how and where competitors play strongly and with which partners. PEIP can instantly provide a deep and detailed analysis of the competitive digital footprint of their competitors across partners worldwide. This makes it easy for vendors to see market opportunity, shift MDF funds where they don’t seem to be effective, and shore up team resources that need additional help to gain traction, etc.

To learn more about PartnerOptimizer’s category-defining new Partner Ecosystem Intelligence Platform, register for the launch webinar on August 24 at 9 a.m. PST/12 p.m. EST, click here. Ready for demo or a free trial of the platform and/or to learn how Partner Optimizer’s concierge service team of data scientists can also help companies identify their IPP and build out their contacts – click here to schedule a call or demo, and here for a free trial.

Source: PartnerOptimizer