By Chris Poupart

MSPs continued to bet on Unified Communications as a Service (UCaaS) in 2018, despite ongoing concerns about margins and a shortage of technical resources. That’s just one of the key takeaways from the recently released UCaaS as Part of Managed IT Business report published by master solutions provider LANtelligence and management consultant The Corlea Group.

The two San Diego-based firms joined forces to capture feedback from over 100 MSPs across North America in order to identify current trends, opportunities, and challenges in the UCaaS market.

The study portrays a growing and viable market opportunity for MSPs while also highlighting the challenges of solution differentiation in the face of increased competition (especially from carriers) and securing technical support resources.

Transitioning Voice Market Remains an Opportunity for MSPs

While a minority of responding MSPs are currently not selling UCaaS, almost 9 in 10 survey respondents are actively promoting the solution (a significant increase over 2017). Many MSPs commented that they recognized the growth potential of UCaaS, and needed it in their portfolios to remain competitive.

Other research bears this out. Frost & Sullivan is forecasting the North American UCaaS market will experience double-digit annual growth from 2018 through to 2023, and Gartner estimates that “by 2021, 90% of IT leaders will not purchase new premises-based UC infrastructure… because future cloud UC offerings will be far ahead in terms of features, functions, portals, analytics, and dashboards.”

As a result, many MSPs feel compelled to participate in the hot UCaaS market, if only to maintain their voice market share and defend against competitors who are leveraging UCaaS to position other XaaS solutions to their customers.

While over 80% of responding MSPs plan to increase their UCaaS business over the next two years, many are proceeding with caution when investing in new UCaaS offers — more than half (67%) are only providing one or two UCaaS solutions to their clients. This choice reflects the initial cost and technology barriers involved with onboarding a new UCaaS solution.

Margins and Differentiation are Key Issues

Shrinking margins were a top concern for survey respondents, many of whom pointed to price competition from the carriers. A common view was that aggressive, high-volume pricing from service providers was driving down MSP margins, making it more difficult for them to compete in the UCaaS market.

With this in mind, many MSPs (43%) are looking to collaborate with their vendors to create additional value and differentiate themselves from the carriers and other UCaaS providers. Often this differentiation comes in the form of services — design, deployment, and applications integration — and the survey results indicate that MSPs see room for improvement in vendor technical expertise and support.

Technical Resource Availability an Ongoing Challenge

The concern about the availability of technical resources is repeated throughout the LANtelligence/Corlea Group report. As MSPs push for differentiation, 2 out of 3 survey respondents (67%) cited a gap in the resources necessary to design, deploy, and project manage cloud-based voice solutions — up from 53% in 2017.

MSPs face a familiar dilemma in addressing these technical hurdles. Building in-house capabilities — hiring, training, and certifying — is time-consuming and expensive. The alternative, partnering with a vendor or another solutions provider, can limit the MSP’s solution options, and in some cases, introduce new competition into the opportunity. The LANtelligence/Corlea Group survey found that ‘concerns about UCaaS providers also selling competing services’ grew by 28% year over year.

Applications Integration — A Growing Concern

MSPs raised a new issue in the 2018 survey — applications integration. Over 35% said it was a challenge to integrate vendor solutions with customer applications such as CRM or DMS.

Vendors are working overtime to address this challenge. RingCentral, for example, offers its Connected Development Platform with a range of APIs and SDKs to facilitate applications integration. 8×8 takes a similar approach, providing an integration framework built upon industry-standard APIs, and integration already completed for a wide range of popular applications.

Still, as MSPs become involved in more complex UCaaS projects, many are finding it difficult to obtain the skilled resources they need to meet their customers’ application integration requirements.

Overall Satisfaction is Positive

Despite the challenges they face in the UCaaS arena, the general outlook is positive for MSPs, with almost 62% planning to increase their UCaaS business in the next 6-12 months. As well, satisfaction with UCAAS practice revenues has increased significantly — 59.6% in 2018, versus 40% in 2017.

Unfortunately, MSP satisfaction with providers’ sales and technical support, deployment, and training has not improved year over year, reflecting the same ‘moderate to positive’ results from the 2017 report. This perceived lack of provider support may become critical as the complexity of UCaaS projects and customer integration requirements increase.

The Opportunity for MSPs — and UCaaS Providers

To grow their UCaaS business, MSPs are seeking partners who can supplement their technical resources and help address gaps in their offers (up 21.6% from the 2017 survey). MSPs were clear, however, that they would only seek partners who would not compete against them with other solutions and services.

MSPs may see benefits from partnering with solutions providers or master agents — as well as limitations. Working with a solution provider may limit an MSP’s technology options, and MSPs often find integration and support offers don’t provide the flexibility they need.Similarly, master agents are often resource constrained, and may not provide the project management or the integration expertise that MSPs require.

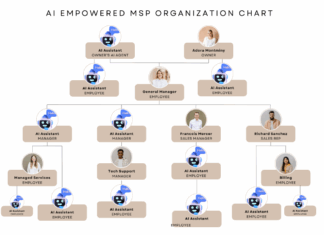

Some UCaaS vendors, including the emerging master solutions providers, are taking a comprehensive approach in addressing the technical and resource challenges identified in the 2018 LANtelligence/Corlea Group report. They are working hard to build more robust partner models that combine best-in-class UCaaS solution options with full technical and project management support across the entire technology lifecycle. These new models may provide welcome relief to MSPs as they continue to grow their UCaaS business.